News of a new, highly virulent COVID variant triggered a market sell-off on Friday, sending stocks into negative territory for the week.

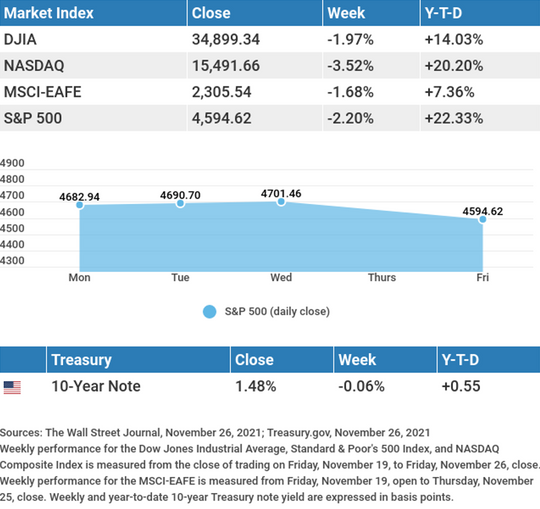

The Dow Jones Industrial Average slid 1.97%, while the Standard & Poor’s 500 slumped 2.20%. The Nasdaq Composite index lost 3.52% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 1.68%.1,2,3

Red Friday

Investors woke up on Black Friday to reports of a mutated COVID variant, reviving fears of potential new economic restrictions. U.S. markets were not alone, as stock prices in Europe and Asia also tumbled.

Friday’s market action saw declines in economic reopening stocks, such as travel and leisure, cyclicals, financials, and energy, while some of the so-called stay-at-home stocks and pharmaceutical stocks experienced gains. Yields retreated amid a flight to safety and the potential that this turn of events may lead to a slowdown in the Fed’s bond tapering program and a delay in contemplated rate hikes. Prior to Thanksgiving the markets had been choppy, but largely trending higher for the week, while yields had moved up with the renomination of Fed Chair Powell.

Powell Renominated

President Biden announced last week that he was renominating Jerome Powell to serve another term as chairman of the Federal Reserve Bank, ending market speculation surrounding his renomination.

President Biden cited the need for stability and independence in a time of uncertainty in making his decision. While Powell’s renomination faced resistance, Senate approval appears likely. Coincident with Powell’s renomination, President Biden also nominated Lael Brainard, a member of the Federal Reserve Board of Governors, to serve as vice chair. Investors can soon expect further Fed nominations by the Biden Administration to fill vacancies created by term expirations and retirements.

This Week: Key Economic Data

Tuesday: Consumer Confidence.

Wednesday: ADP (Automated Data Processing) Employment Report. ISM (Institute for Supply Management) Manufacturing Index.

Thursday: Jobless Claims.

Friday: Employment Situation. Factory Orders.

Source: Econoday, November 26, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Salesforce.com, Inc. (CRM), Hewlett Packard Enterprise Company (HPE).

Wednesday: Okta, Inc. (OKTA), Snowflake, Inc. (SNOW), CrowdStrike (CRWD).

Thursday: Marvell Technology, Inc. (MRVL), Dollar General (DG), The Kroger Co. (KR), DocuSign (DOCU).

Source: Zacks, November 26, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.