A fresh wave of positive corporate earnings surprises sent markets to new record highs last week.

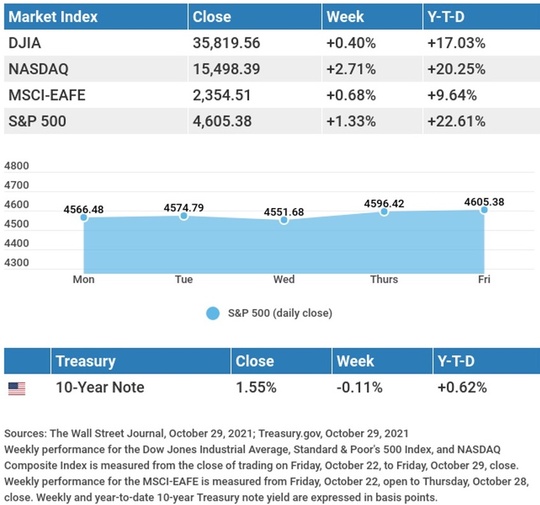

The Dow Jones Industrial Average increased 0.40%, while the Standard & Poor’s 500 rose 1.33%. The Nasdaq Composite index picked up 2.71% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was up 0.68%.1,2,3

Earnings Drive Market

The week kicked off with the Dow Jones Industrials and S&P 500 index setting record highs as the financial markets carried over the previous week’s price momentum.4

Stocks continued to climb on a string of forecast-beating earnings results. With about half of the S&P 500 constituent companies having reported earnings, more than 80% of them have beaten Wall Street analysts’ consensus estimates. Based on these results, earnings for all S&P 500 companies are expected to come in approximately 39% above the third quarter of last year. (Forecasts are based on assumptions, and may not materialize.) Stocks overcame disappointing earnings from two mega-cap tech names on Friday to maintain the week’s solid gains.5

GDP Growth Slows

While businesses managed to post strong earnings in the third quarter, the first look at economic growth came in below consensus estimates. The Gross Domestic Product (GDP) grew at a 2.0% annualized rate in the third quarter, a slowdown from the two previous quarters, each of which posted annualized growth rates in excess of 6%.6

The spread of the Delta variant and backlogs in the supply chain were two major factors dragging on economic activity.

This Week: Key Economic Data

Monday: ISM (Institute for Supply Management) Manufacturing Index.

Wednesday: ADP (Automated Data Processing) Employment Report. Factory Orders. ISM (Institute for Supply Management) Services Index. FOMC (Federal Open Market Committee) Announcement.

Thursday: Jobless Claims.

Friday: Employment Situation.

Source: Econoday, October 29, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Simon Property Group, Inc. (SPG).

Tuesday: Pfizer, Inc. (PFE), Activision Blizzard, Inc. (ATVI), Amgen, Inc. (AMGN), Marathon Petroleum Corporation (MPC), ConocoPhillips (COP), Prudential Financial (PRU), Mondelez International, Inc. (MDLZ), TMobile US, Inc. (TMUS), The Estee Lauder Companies, Inc. (EL).

Wednesday: CVS Health Corporation (CVS), Qualcomm, Inc. (QCOM), Electronic Arts (EA), Humana, Inc. (HUM), Booking Holdings, Inc. (BKNG), Match Group, Inc. (MTCH), Emerson Electric (EMR).

Thursday: Square, Inc. (SQ), Albemarle Corporation (ALB), Southern Companies (SO), Cigna Corporation (CI), Skyworks Solutions, Inc. (SWKS), Regeneron Pharmaceuticals, Inc. (REGN).

Friday: DraftKings, Inc. (DKNG).

Source: Zacks, October 29, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.