Hawkish comments by the Fed and weak economic data heightened investors’ recession concerns and sent stocks lower last week.

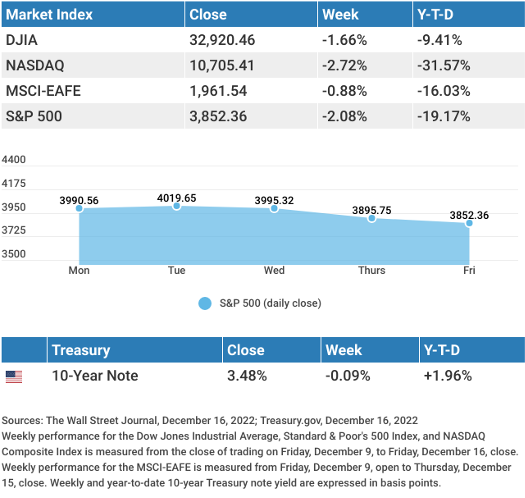

The Dow Jones Industrial Average lost 1.66%, while the Standard & Poor’s 500 retreated 2.08%. The Nasdaq Composite index declined 2.72% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.88%.1,2,3

Stocks Under Pressure

Stocks began the week on a positive note, supported by a cooler-than-expected Consumer Price Index (CPI) report. Stocks reversed direction mid-week, however, following the Federal Open Market Committee (FOMC) meeting in which another 0.5% rate hike was announced.

The half-point increase was widely anticipated, but the increase in the terminal rate (i.e., the point at which the Fed stops raising rates) rattled investors. Continued hawkishness by Fed Chair Powell at the post-meeting press conference added to investors’ anxiety. The potential for higher rates for longer, along with disappointing economic data, particularly a sharp decline in retail sales, amplified fears of a recession and sent stocks lower for the remainder of the week.

Inflation and the Fed

The release of November’s CPI showed inflation cooling for the second consecutive month, as prices rose just 0.1% month-over-month and 7.1% from a year ago. Both were better than expected.4

The FOMC ended its last meeting of 2022 by raising interest rates another 0.5% and signaling that it would likely continue to hike rates into the new year. At a subsequent press conference, Fed Chair Powell commented that the next rate increase could be a quarter-percentage point. Most FOMC members appear to support raising the terminal rate (the point at which hikes end) to above 5%, up from its September projection of 4.6%.5

This Week: Key Economic Data

Tuesday: Housing Starts.

Wednesday: Consumer Confidence. Existing Home Sales.

Thursday: Jobless Claims. Gross Domestic Product (GDP). Index of Leading Economic Indicators.

Friday: New Home Sales. Durable Goods Orders. Consumer Sentiment.

Source: Econoday, December 16, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: FedEx Corporation (FDX), Nike, Inc. (NKE), General Mills, Inc. (GIS).

Wednesday: Micron Technology, Inc. (MU).

Source: Zacks, December 16, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.