The Week on Wall Street

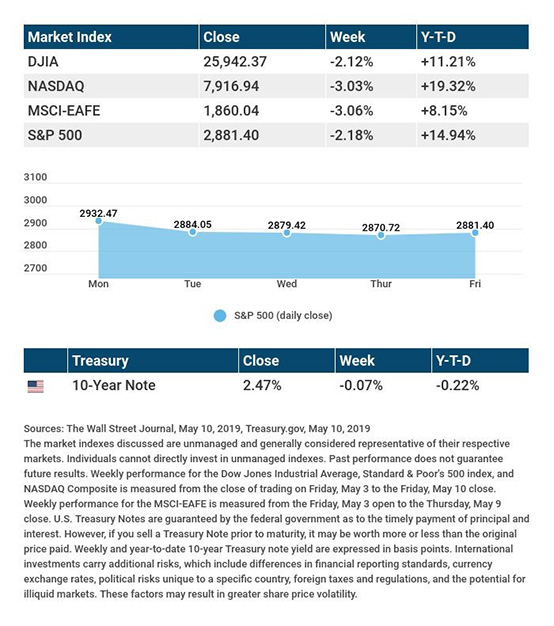

As we noted recently, Wall Street has a wandering eye. Last week, it focused on the new tariff threats in the ongoing U.S.-China trade dispute. Stocks fell across five trading sessions: the Dow Jones Industrial Average lost 2.12%, the S&P 500, 2.18%; the Nasdaq Composite, 3.03%. International stocks also fell: the MSCI EAFE index declined 3.06%.

Earnings and big-name initial public offerings mattered little last week. Traders were more concerned about how consumers and corporations might be affected by higher import taxes in future quarters.[1][2]

Tariffs Increase

At 12:01 a.m. Friday, duties on $200 billion worth of Chinese products coming to the U.S. rose from 10% to 25%. Just days earlier, President Trump had tweeted that the U.S. might also tax another $325 billion of Chinese imports, mainly consumer goods.

While the proposed new taxes might take months to implement, institutional investors reacted negatively to this information, perceiving that trade talks were stalled.[3][4]

Final Thought

A few weeks ago, market watchers noted the huge number of initial public offerings anticipated for 2019. One well-known tech firm completed its IPO on Friday, and the wave of tech IPOs is still building. According to research firm CB Insights, the average stock market valuation of the venture-capital-backed tech companies going public this year is $9.6 billion.[5]

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: April retail sales figures from the Census Bureau.

Friday: The University of Michigan’s preliminary May consumer sentiment index, a measure of consumer confidence.

Source: Econoday / MarketWatch Calendar, May 10, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Take-Two Interactive (TTWO)

Tuesday: Agilent (A), Ralph Lauren (RL)

Wednesday: Alibaba (BABA), Cisco (CSCO), Macy’s (M)

Thursday: Applied Materials (AMAT), Nvidia (NVDA), Walmart (WMT)

Friday: Deere & Co. (DE)

Source: Morningstar.com, May 10, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[1] www.wsj.com/market-data

[2] quotes.wsj.com/index/XX/990300/historical-prices

[3] www.cnn.com/2019/05/10/business/china-us-tariffs-trade/index.html

[4] www.cnbc.com/2019/05/07/if-trump-slaps-china-with-all-the-tariffs-threatened-it-could-be-the-us-consumer-that-pays.html

[5] www.nytimes.com/interactive/2019/05/09/business/dealbook/tech-ipos-uber.html