The Week on Wall Street

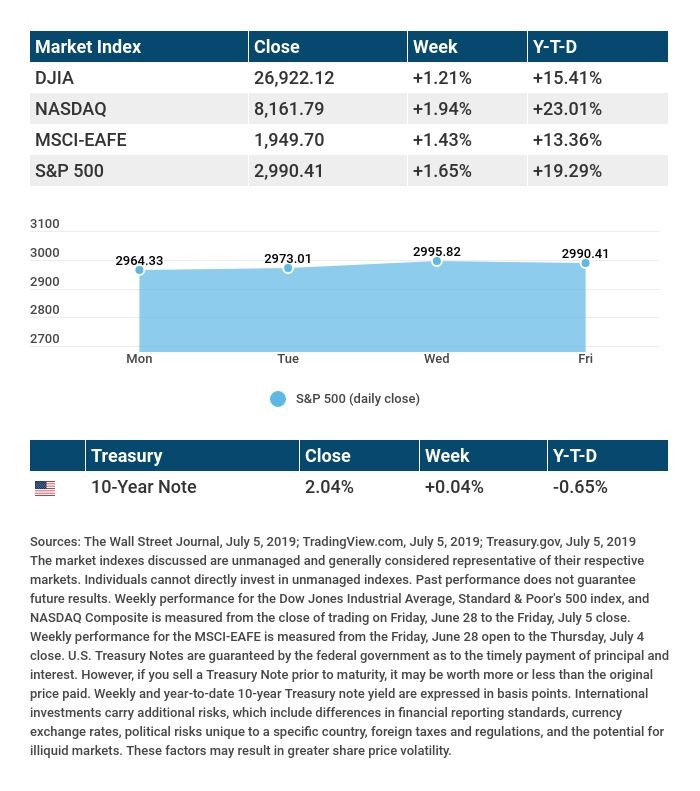

U.S. stock benchmarks opened a new quarter positively. The S&P 500 gained 1.65% in the opening week of July; the Dow Jones Industrial Average, 1.21%; the Nasdaq Composite, 1.94%. Overseas, stocks in developed markets, tracked by MSCI’s EAFE index, rose 1.43%.[1][2][3][4]

On July 3, the S&P posted its latest record close: 2,995.82. In other news, the Department of Labor said that the economy added 224,000 net new jobs in June, far more than the 160,000 projected by analysts in a Bloomberg poll. The headline jobless rate ticked up 0.1% to 3.7% in June; the U-6 rate, including the underemployed, also rose 0.1% to 7.2%. Finally, the Office of the U.S. Trade Representative said that the federal government plans to levy new tariffs on $4 billion of food and beverages coming from the European Union.[5][6][7]

Monday, July 15 will mark the start of the next earnings season. Money-center banks report first, followed by companies from a variety of industries. As Wall Street gets ready for their results, we will take a moment to recap Q2 index performance and the quarter’s two biggest news developments.

Stocks Rose, Fell, and Rose Again

The S&P 500 gained 3.93% in April, dropped 6.58% in May, and climbed 6.89% in June. In the end, it advanced 3.79% for the quarter, outdoing the Q2 gains of the Nasdaq Composite (3.58%) and Dow Industrials (2.59%).[8][9]

The Fed Hinted at a Shift in Monetary Policy

The central bank’s June statement took out a reference about being “patient” on borrowing costs and noted that Fed policymakers would “act as appropriate” to try and sustain economic growth. The latest dot-plot, showing the opinions of Fed officials about where interest rates might be in the near future, showed nothing like consensus.[10]

U.S.-China Trade Talks Stalled, But May Resume Soon

In May, the U.S. and China announced they would hike tariffs on each other’s exports during the quarter. Formal trade negotiations broke down for six weeks. On June 29, President Trump announced at the Group of 20 summit in Japan that talks would soon resume and that the U.S. would hold off on tariffs slated for another $300 billion in Chinese goods.[11][12]

What’s Next

As the quarter gets underway, traders are wondering if an interest rate adjustment and a U.S.-China trade deal are in store for the summer; there is also some ambiguity about the economy’s momentum. Investors will have plenty to consider in the coming weeks.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Federal Reserve Chairman Jerome Powell delivers opening remarks at a conference at the Federal Reserve Bank of Boston.

Wednesday: Fed Chair Powell testifies on monetary policy in Congress, and the Fed also releases the minutes from its June meeting.

Thursday: The June Consumer Price Index appears, showing monthly and yearly changes in inflation.

Source: Econoday / MarketWatch Calendar, July 5, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: PepsiCo (PEP)

Wednesday: Bed Bath & Beyond (BBBY)

Thursday: Delta Air Lines (DAL), Fastenal (FAST)

Source: Zacks.com, July 5, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[1] quotes.wsj.com/index/DJIA/historical-prices

[2] quotes.wsj.com/index/COMP/historical-prices

[3] quotes.wsj.com/index/SPX/historical-prices

[4] quotes.wsj.com/index/XX/990300/historical-prices

[5] www.marketwatch.com/story/sp-500-heads-for-3rd-straight-record-ahead-of-private-sector-jobs-report-2019-07-03

[6] fortune.com/2019/07/05/us-hiring-jobs-data-rebounds/

[7] www.cnn.com/2019/07/02/economy/us-tariffs-on-eu/index.html

[8] money.cnn.com/data/markets/sandp/

[9] www.tradingview.com/markets/indices/quotes-us/

[10] www.bloomberg.com/news/articles/2019-06-19/fed-scraps-patient-rate-approach-in-prelude-to-potential-cut

[11] www.piie.com/blogs/trade-investment-policy-watch/trump-trade-war-china-date-guide

[12] www.bloomberg.com/news/articles/2019-06-29/xi-trump-agree-to-restart-trade-talks-china-says