Stock prices inched higher last week amid declining COVID-19 cases, a pick-up in vaccinations, and progress on a fiscal relief bill.

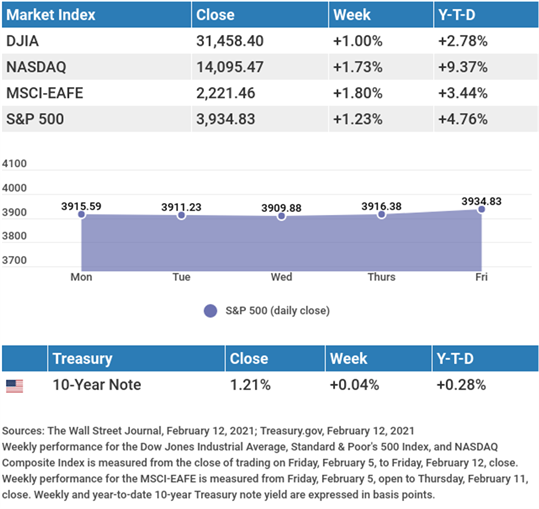

The Dow Jones Industrial Average gained 1.00%, while the Standard & Poor’s 500 rose 1.23%. The Nasdaq Composite index climbed 1.73% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 1.80%.1,2,3

Stocks Post Gains

Stocks powered higher to begin the week, buoyed by rising confidence in economic recovery and the potential for another round of fiscal stimulus. Small cap stocks continued their 2021 rally as investors looked for out-of-favor names that might benefit from an economic rebound.

Stocks traded in a tight range through the remainder of the week. Investors appeared to digest current stock price valuations, wondering if the market had already “priced in” the optimism of a rebounding economy.

On Wednesday, Fed Chair Powell gave assurances that the Fed’s rate policy would remain unchanged for the foreseeable future. Some fear that inflation may pick up with broader reopenings and additional fiscal stimulus.4

On Thursday and Friday, stocks drifted mostly higher in quiet trading, managing to set some new all-time highs.5

Economic Expectations Rising

A survey by The Wall Street Journal showed increasing optimism among economists about economic growth for this year.6

Among the survey’s findings, economists, on average, now expect the economy to expand by 4.9%, an increase from their average estimate of 4.3% last month. They are, however, somewhat less sanguine about employment as they now expect 4.8 million jobs to be added this year, versus an earlier expectation of 5.0 million.6

Economists are forecasting accelerating inflation as a consequence of economic growth and fiscal stimulus, but believe that there is only a 17.5% probability of an economic downturn in the next 12 months, an improvement from its 21.2% risk estimate in January.6

This Week: Key Economic Data

Wednesday: Retail Sales. Industrial Production. Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims. Housing Starts.

Friday: Existing Homes Sales. Purchasing Managers Index (PMI) Composite Flash.

Source: Econoday, February 12, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: CVS Health Corp. (CVS), Agilent Technologies (A), Palantir Technologies, Inc. (PLTR).

Wednesday: Twilio, Inc. (TWLO), Shopify, Inc. (SHOP), Baidu (BIDU).

Thursday: Walmart (WMT), Albemarle (ALB), Roku (ROKU), Waste Management (WM), Ventas (VTR), Marriott International (MAR).

Source: Zacks, February 12, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.