Stocks moved to the rhythm of earnings season last week, initially rising on positive earnings surprises and faltering later in the week on key earnings disappointments.

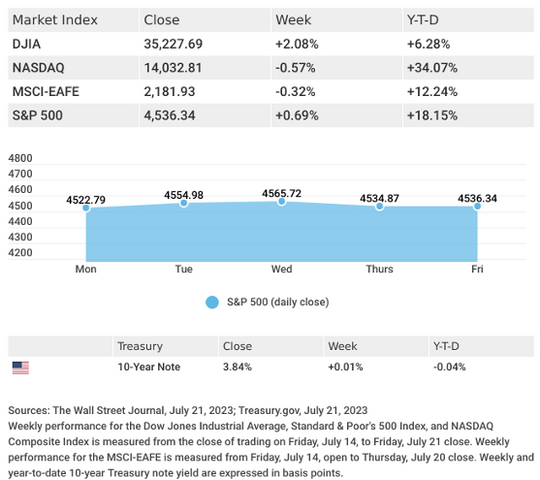

The Dow Jones Industrial Average rose 2.08%, while the Standard & Poor’s 500 added 0.69%. The Nasdaq Composite Index slumped 0.57% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.32%.1,2,3

Earnings in Focus

Entering its first big week of the second quarter earnings season, solid reports from the nation’s big banks rewarded investor optimism, sparking a rally that continued into mid-week. An announcement by a mega-cap tech company of a new AI subscription plan, and stabilizing deposits at several regional banks, further fed investor enthusiasm.

Disappointing earnings from two big-tech names dragged market indices lower on Thursday, with the largest losses in the Nasdaq composite. Despite the reversal, 20 stocks in the S&P 500 touched 52-week highs on Thursday, with 11 reaching all-time highs.4

Stocks closed flat to end an otherwise mixed week.

Housing Hits a Bump

June housing reports reminded investors that any emerging housing recovery remains shaky. After a massive 21.7% jump in housing starts in May, new home construction tumbled 8.0% in June, with building permits (an indicator of future home construction) dropping 3.7%.5

Sales of existing homes were also lower in June, declining by 3.3%, owing to a persistently low inventory level. This was the slowest pace since January. Year-over-year sales were lower by 18.9%. One reason for low inventory is that homeowners have been reluctant to sell homes on which many have a historically low mortgage rate and face buying a new home at elevated prices with a much higher mortgage interest rate.6

This Week: Key Economic Data

Monday: Purchasing Managers’ Index (PMI) Composite Flash.

Tuesday: Consumer Confidence.

Wednesday: FOMC Announcement. New Home Sales.

Thursday: Gross Domestic Product. Durable Goods Orders. Jobless Claims.

Friday: Personal Income and Outlays.

Source: Econoday, July 21, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Microsoft Corporation (MSFT), General Electric Company (GE), Verizon Communications, Inc. (VZ), Visa, Inc. (V), Alphabet, Inc. (GOOGL), NXP Semiconductors, N.V. (NXPI), General Motors Company (GM), Archer Daniels Midland Company (ADM), 3M Company (MMM), Texas Instruments, Inc. (TXN), NextEra Energy, Inc. (NEE), Kimberly-Clark Corporation (KMB).

Wednesday: AT&T, Inc. (T), The Boeing Company (BA), The CocaCola Company (KO), Lam Research Corporation (LRCX), Union Pacific Corporation (UNP), ServiceNow, Inc. (NOW), Thermo Fisher Scientific, Inc. (TMO), General Dynamics Corporation (GD), O’Reilly Automotive, Inc. (ORLY), Chipotle Mexican Grill, inc. (CMG).

Thursday: Amazon.com, Inc. (AMZN), Intel Corporation (INTC), Ford Motor Company (F), AbbVie, Inc. (ABBV), Mastercard, Inc. (MA), Bristol Myers Squibb Company (BMY), McDonald’s Corporation (MCD), Northrop Grumman Corporation (NOC), HCA Healthcare, Inc. (HCA), Honeywell International, Inc. (HON), T-Mobile US, Inc. (TMUS), Southwest Airlines Co. (LUV), Boston Scientific Corporation (BSX).

Friday: Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), The Procter & Gamble Company (PG).

Source: Zacks, July 21, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.