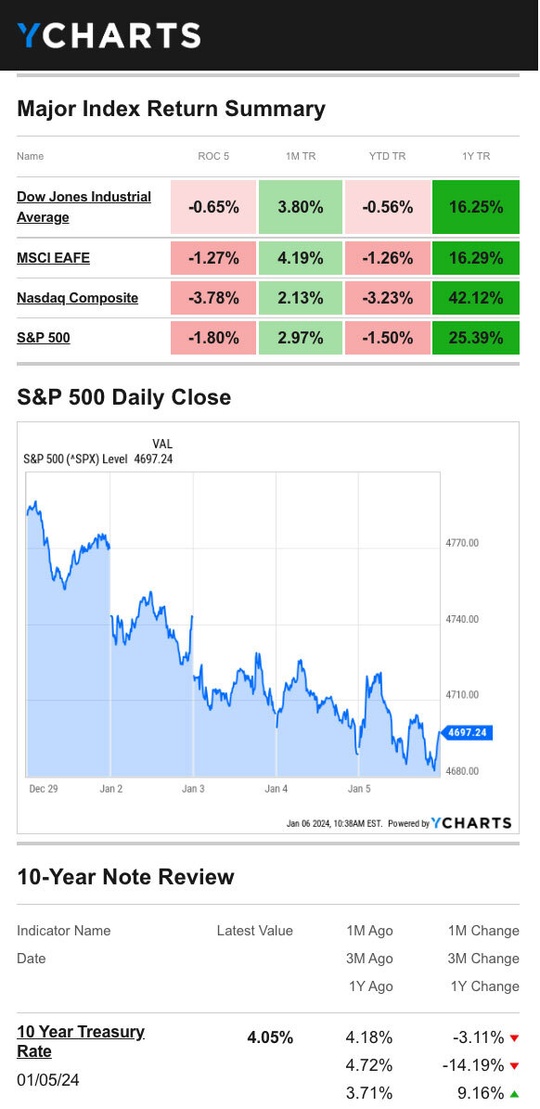

Stocks retreated in the first trading week of 2024, struggling a bit after a celebratory end to last year as investors second-guessed Fed signals and fretted over lingering inflation concerns.

New Year Blues

Stocks got off to a rough first week of the new year, with tech names leading the week’s decline. Several market observers called it the “reverse Goldilocks” effect, where the market decided investors were getting a little too excited over the prospect of a Fed rate cut.

Stocks bounced up and down each of the four trading days but ended each one down—except Friday, when the Dow Industrials, Nasdaq Composite, and S&P 500 all ended the day in the green when jobs data helped soften the week’s slide.1,2

All About the Fed

On Wednesday, manufacturing news came in better than expected, lifting markets until the December Federal Open Market Committee meeting minutes were released, revealing that the Fed members had discussed rate cuts for 2024 but in no specific terms.

Jobs and services sector news painted a better picture of the economy on Thursday, but as the 10-year Treasury hit 4%, stock prices responded negatively.

Jobs Data in Focus

Finally, employment data helped buffer the week on Friday, as employers added 216,000 new jobs in December, besting estimates from economists and surpassing the 173,000 jobs added in November. News of unemployment remaining steady at 3.7% also helped sentiment.3,4

This Week: Key Economic Data

Tuesday: International Trade in Goods.

Wednesday: EIA Petroleum Status Report.

Thursday: Jobless Claims. Consumer Price Index. Treasury Statement.

Friday: Producer Price Index.

Source: Investor’s Business Daily, Econoday economic calendar; January 5, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Jefferies Financial Group (JEF)

Tuesday: Albertsons Companies (ACI)

Wednesday: KB Home (KBH), Rite Aid Corporation (RADCQ)

Thursday: Infosys (INFY)

Friday: UnitedHealth Group Inc (UNH), JP Morgan Chase & Co (JPM), Bank of America Corporation (BAC), Wells Fargo & Co (WFC)

Source: Zacks, January 5, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Source: YCharts.com, January 6, 2024. Weekly performance is measured from the close of trading on Friday, December 29, to Friday, January 5, close. Treasury note yield is expressed in basis points.