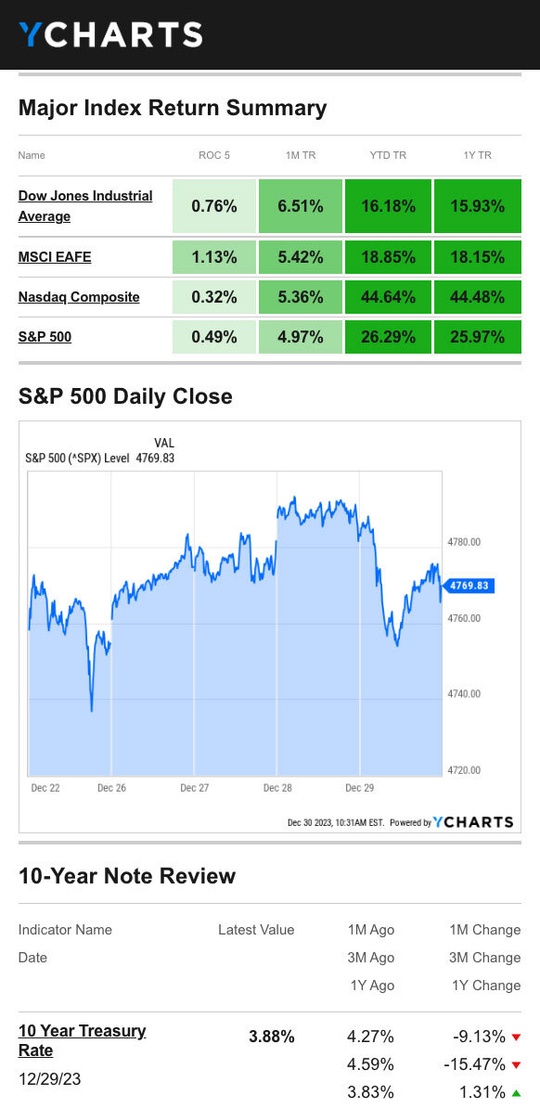

Stocks posted a slight gain last week amid a shortage of news and light holiday trading.

The Dow Jones Industrial Average gained 0.76%, while the Standard & Poor’s 500 added 0.49%. The Nasdaq Composite index advanced 0.32% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, increased 1.13%.1,2,3

Stocks Gain to End Year

The stock market gains in the final trading days of 2023 capped an exceptional year of performance. The last-week rally also mirrored the historical tendency of stocks to rise at this time of year, a propensity known as the “Santa Claus rally.” The Santa Claus rally covers the final five trading days of the calendar year and the first two days of trading in January.

The average return of the S&P 500 during this Santa Claus rally is 1.3% during the past 73 years. Remember that past performance does not guarantee future results, and individuals cannot invest directly in an index.4

The 2023 week’s gains, led by smaller-capitalization stocks and a handful of industry sectors, were partially erased on Friday as light volume and some profit-taking pressured stocks.

Jobless Claims Rise

Initial jobless claims increased by 12,000 to 218,000, which exceeded economists’ forecasts. The four-week moving average, which better illustrates jobless claim trends, was little changed, coming in at 212,000; this was the lowest number since late October.5

Continuing jobless claims, which measures the number of individuals collecting unemployment benefits, was flat from the previous week at 1.88 million.6

This Week: Key Economic Data

Wednesday: Institute for Supply Management (ISM) Manufacturing Index.

Thursday: Automated Data Processing (ADP) Employment Report. Jobless Claims.

Friday: Employment Situation.

Source: Econoday, December 29, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Thursday: Walgreens Boots Alliance, Inc. (WBA), Lamb Weston (LW), Conagra Brands (CAG)

Friday: Constellation Brands, Inc. (STZ)

Source: Zacks, December 29, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Source: YCharts.com, December 30, 2023. Weekly performance is measured from the close of trading on Friday, December 22, to Friday, December 29, close. Treasury note yield is expressed in basis points.